Time: 2023-12-12

Time: 2023-12-12  Views: 643

Views: 643

[Foreword]

In order to better help customers implement digital projects, the "Dison Expert Column" is completely free and open source, paying tribute to Musk's open source spirit! Through 17+ years of professional digital service capabilities, a senior expert consulting team, and rich industry solutions, we continue to add value to the digital transformation of enterprises!

This article is based on Mr. Yang Yongqing, Disen’s chief financial expert, who has 24 years of rich experience in the field of SAP ERP, and combines the common misunderstandings he found in the implementation of ERP projects to publish corresponding research insights and suggestions to protect your SAP financial implementation and delivery.

[Problem Description]

How to set up and use tax rate check and tax tolerance in SAP system?

[Problem analysis]

If the tax rate check is set in the corresponding tax code (transaction code FTXP), when the MIRO/MIR7 invoice is settled, if the tax amount is manually entered, the system will check whether there is a difference between the tax amount calculated based on the tax code and the manually entered tax amount. , the system defaults to allow a difference of 1 minimum currency unit due to rounding. For RMB, a difference of 0.01 yuan is allowed. Consider a purchase order with multiple line items to be settled together. If there are 5 line items, SAP allows the tax difference to be: 0.01*5=0.05 yuan, that is, each material line item is allowed to have a difference of 0.01 yuan.

However, in actual business, there is such a situation: for a line item of a purchase order (material or equipment), the supplier issues several invoices. Under normal circumstances, one invoice has a tax difference of 0.01 yuan, and multiple invoices are issued for settlement. One line item (material or equipment) results in a tax difference greater than 0.01 yuan. For example: after purchasing a piece of equipment, the supplier issued 8 invoices, and each invoice had a tax difference of 0.01 yuan, totaling 0.08 yuan. As a result, the system prompts an error message: "FF707 Tax input is incorrect (code J1, amount xxxx), correct xxxx CNY".

analyze:

It is not recommended to directly cancel the tax rate check (transaction code FTXP). It is recommended to increase the tolerance of the tax rate check.

deal with:

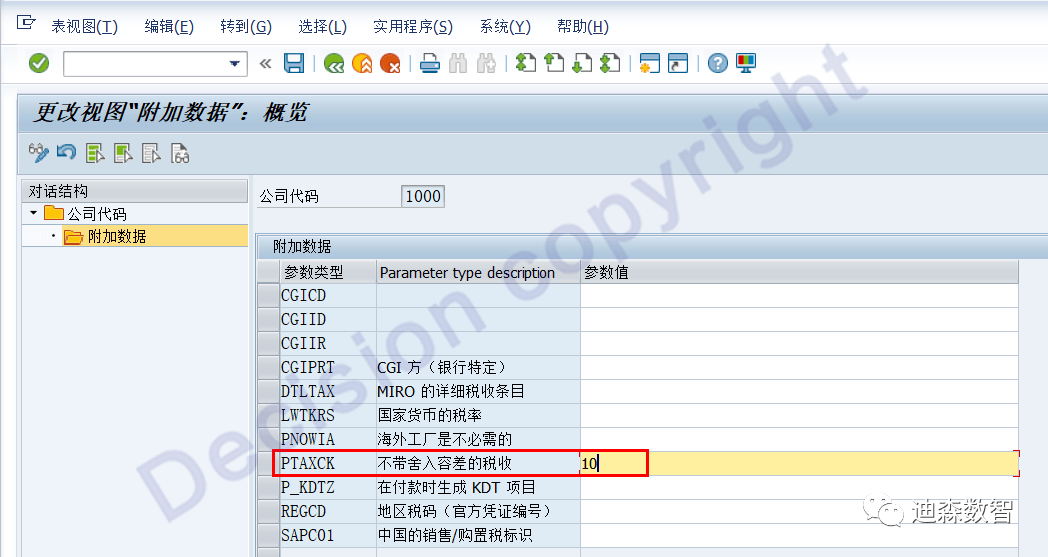

Transaction code: OBY6 After clicking a certain company code, click "Additional Data" and set "Tax without rounding tolerance" to "020", that is, the tolerance is set to 20 differences of 0.01 yuan. If you enter "100 " , that is, the tolerance is set to 100 differences of 0.01 yuan. In subsequent SAP versions, additional data for company codes will be added with separate configuration items as follows:

SPRO -> Financial Accounting -> Financial Accounting Global Settings -> Global Parameters for Company Code -> Maintain Additional Parameters

other:

For manually input tax amounts and system calculated tax amounts, you can use the function VAT_CHECK_TOLERANCE to check whether they pass. If the return value: E_CHECKINDICATOR E_XISOK is empty, the check fails.

[Scenario test]

scene 1:

The tax amount is not set to check the tax amount, and the tax amount is not checked according to the tax rate in the tax code.

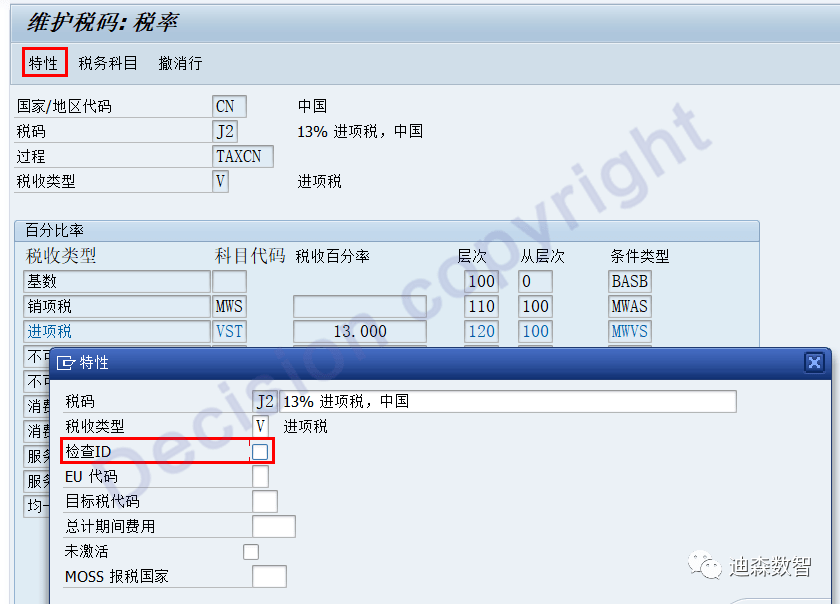

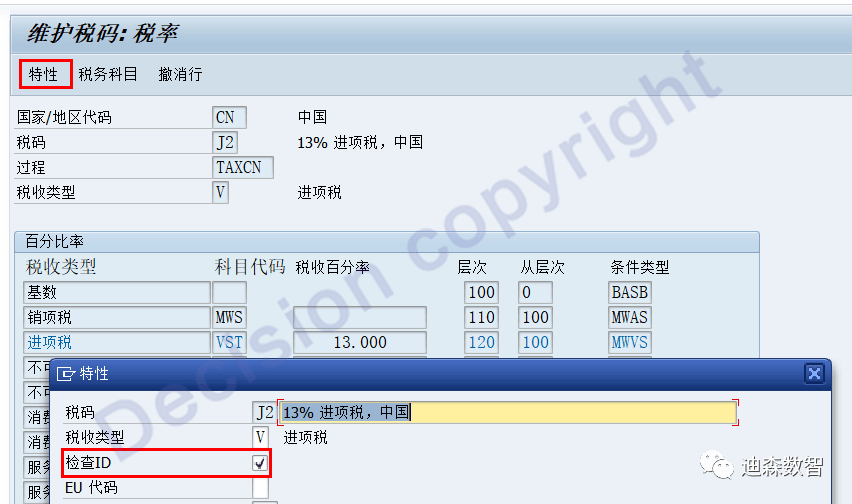

Configure transaction code FTXP

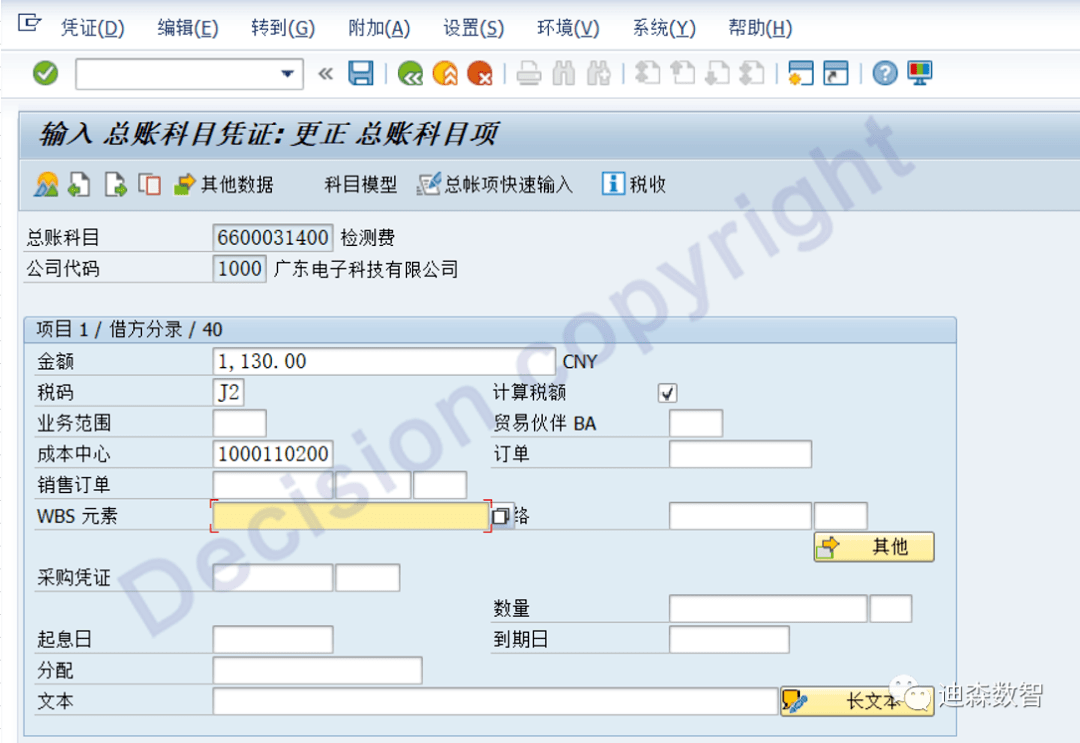

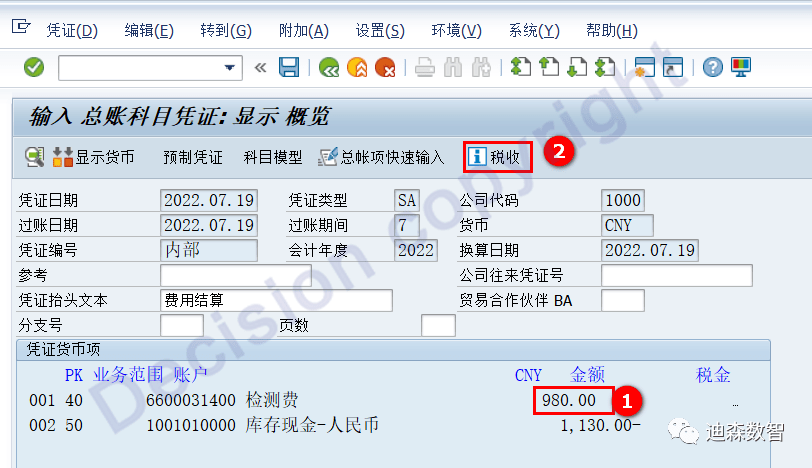

F-02, expense reimbursement accounting

For the first line item, enter the tax-included expense amount of 1,130 yuan, enter the tax code J2 (13% input) and choose to calculate the tax amount.

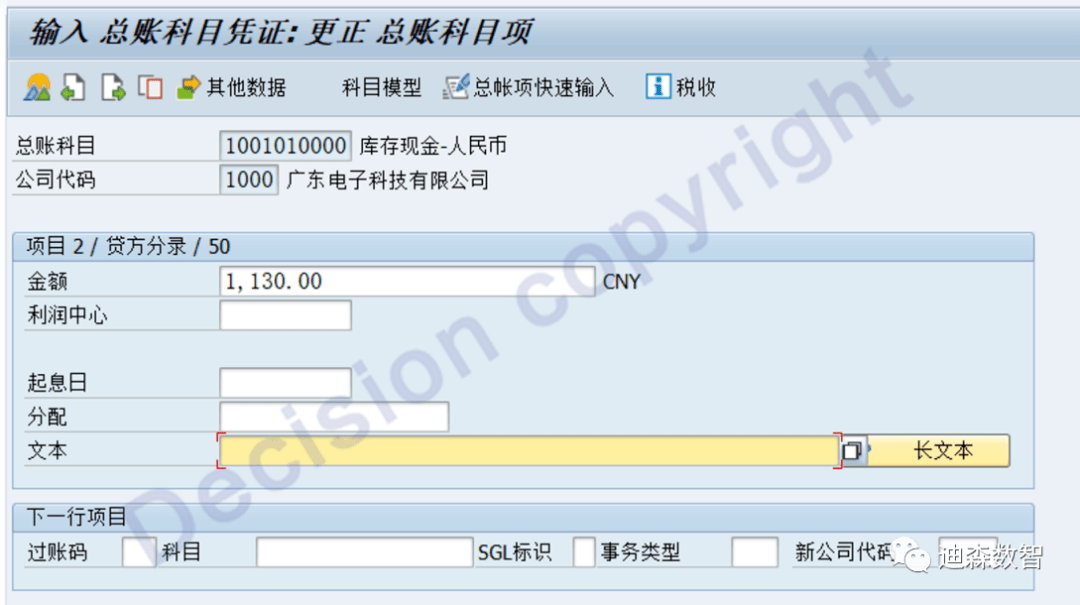

Enter the second line item and enter the payment amount of 1130 yuan.

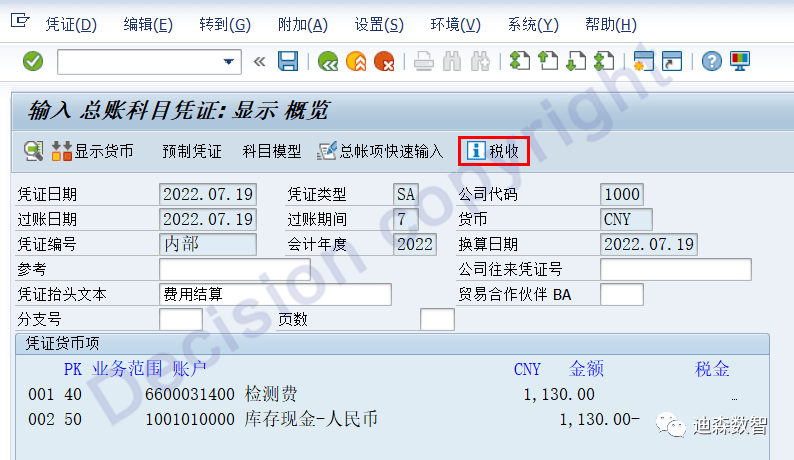

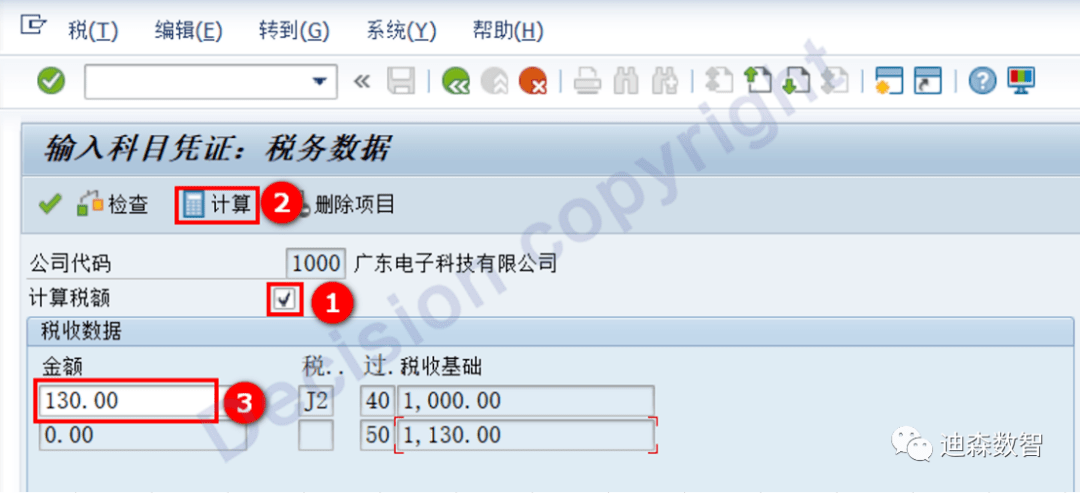

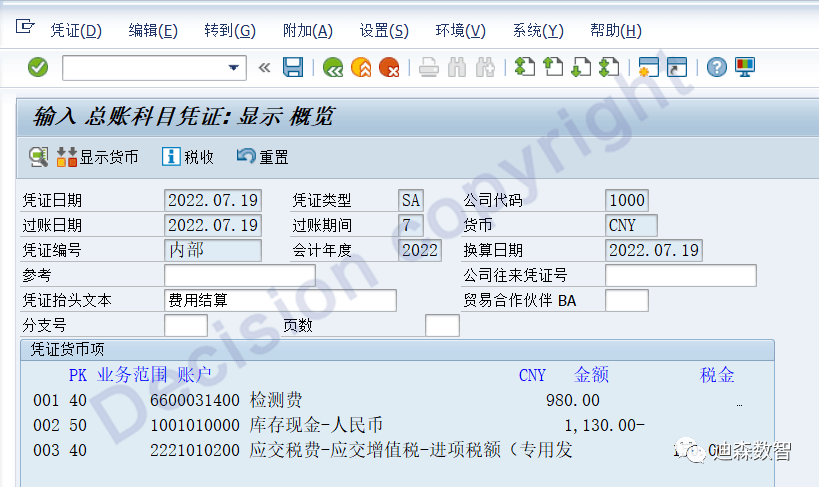

Then click Overview to view the voucher, and then click "Tax".

Under normal circumstances, after following the following operations, the correct tax amount is 130 yuan.

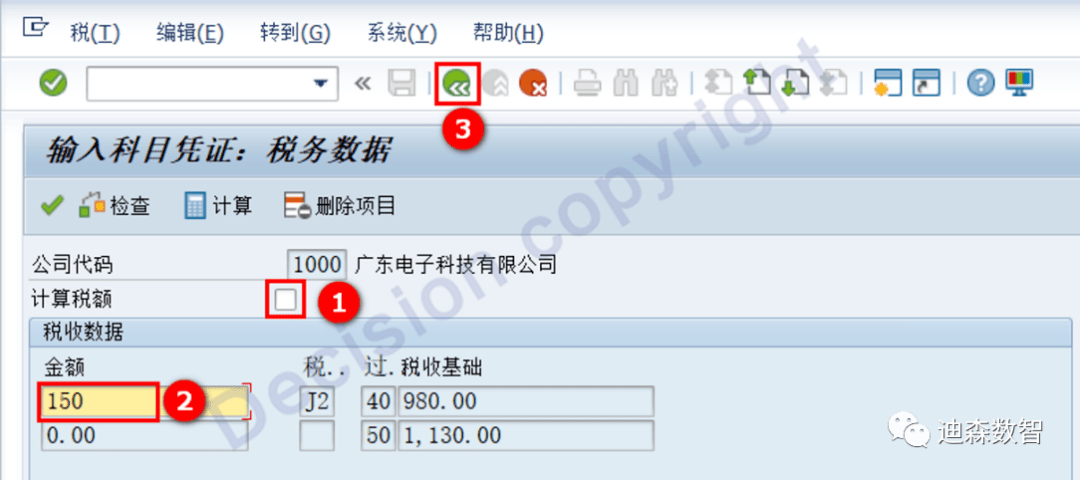

Next, we deliberately modified the tax amount to 150 and the tax base to 980, that is, the tax amount of 150 yuan and the tax rate of 13% do not match!

Double-click the first line item and modify the fee amount to 980.

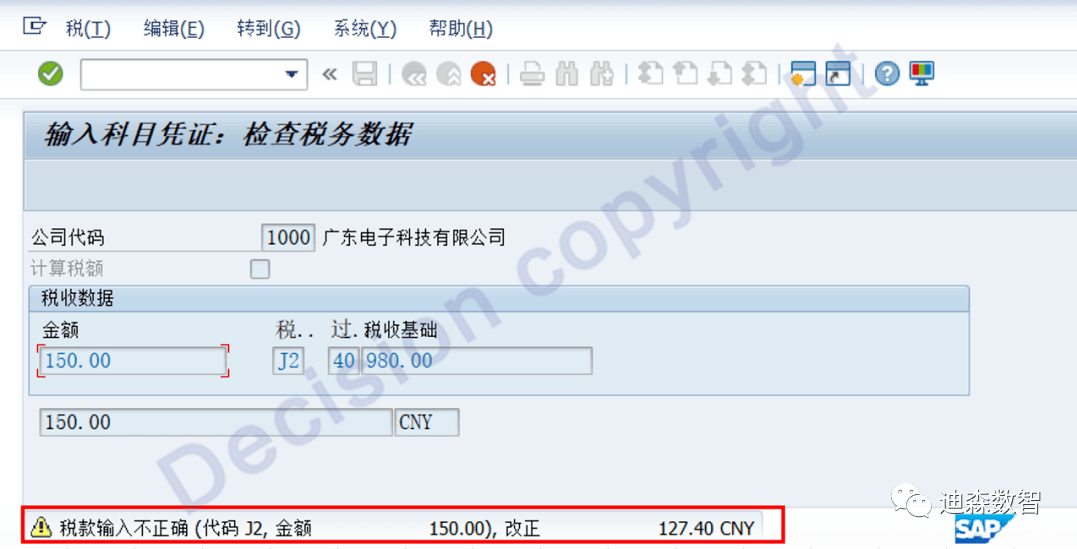

You can see that the system detects that the tax amount does not match the tax rate, but only a warning message is displayed, as follows:

In the end, the voucher can still be posted according to the tax amount of 150 yuan and the J2 13% tax rate.

Summary 1: In this scenario, the system does not strictly require the tax amount to match the tax code!

Scenario 2:

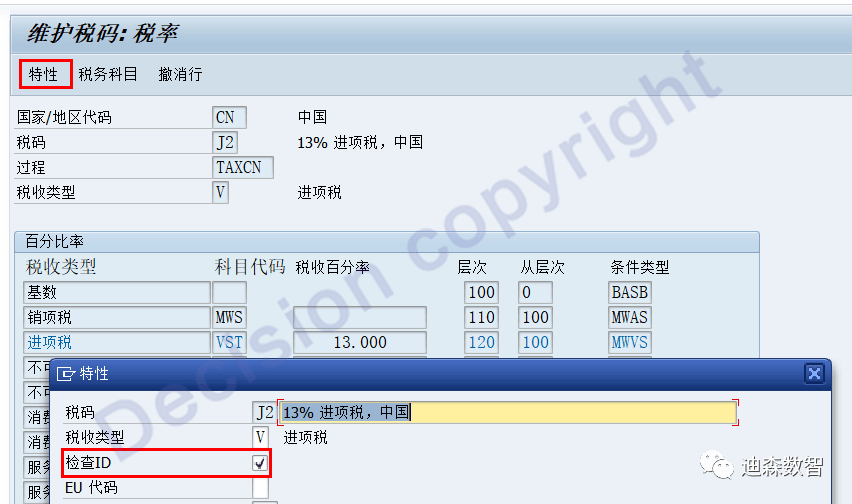

The tax amount setting checks the tax amount and checks the tax amount according to the tax rate in the tax code, but does not set the tax amount tolerance.

Configure transaction code FTXP

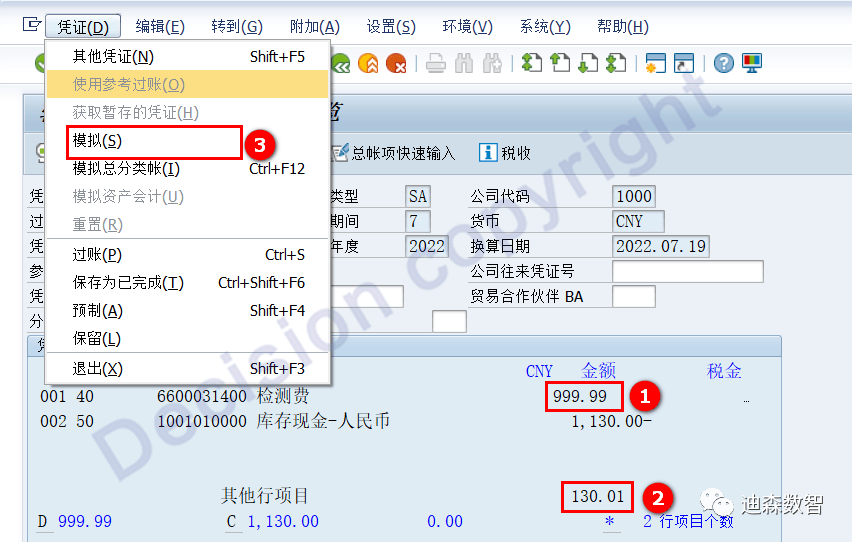

When entering credentials, we test for a one-cent tail difference.

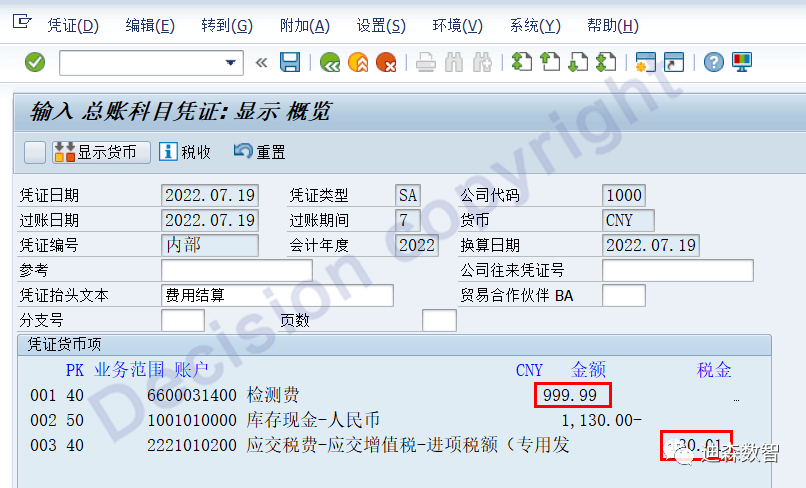

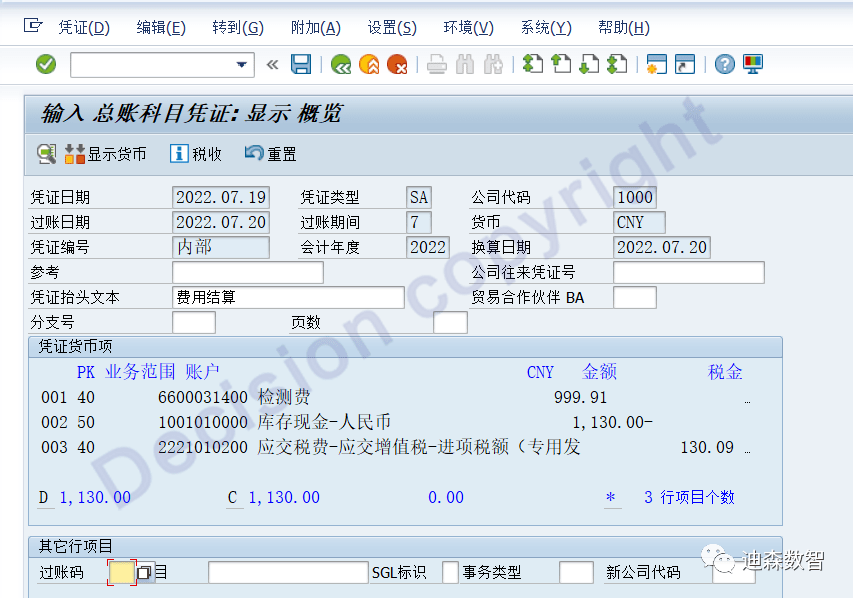

You can see that the simulated credentials are successful.

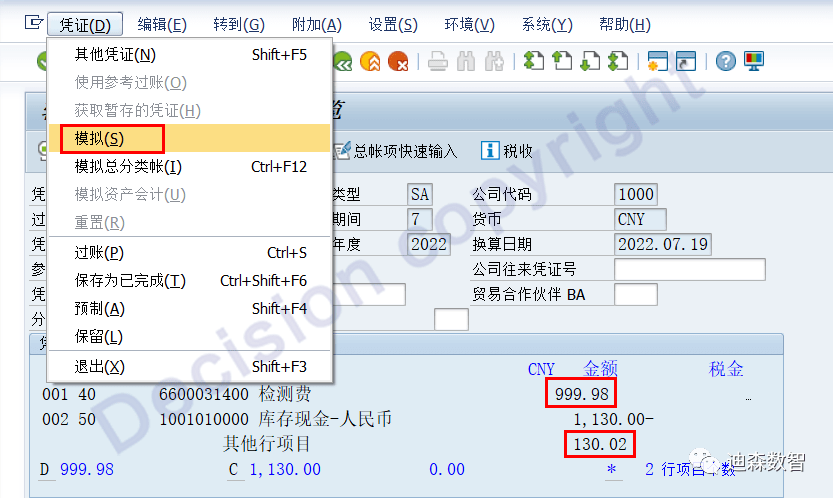

Let’s test the 2-cent tail difference again.

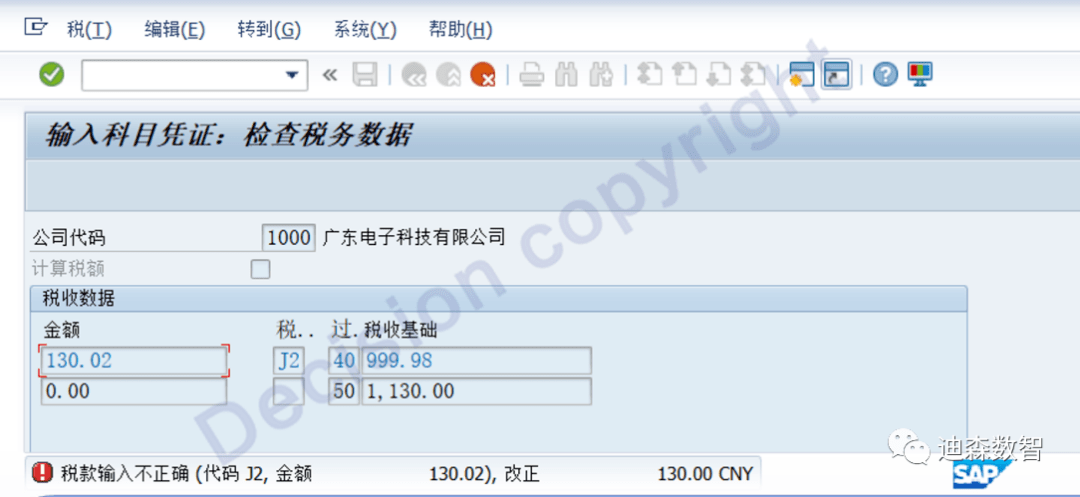

You can see that during the simulation display, the system prompts that the tax amount and tax rate do not match!

Summary 2: In this scenario, the system strictly requires that the tax amount matches the tax code! At this time, the default tax tolerance allowed by the system is 0.01 yuan.

Scene 3:

Set the tax amount to check the tax amount, check the tax amount according to the tax rate in the tax code, and set the tax amount tolerance to 10 basis points.

Configuration 1, transaction code FTXP

Configuration 2, the path is as follows:

SPRO -> Financial Accounting -> Financial Accounting Global Settings -> Global Parameters for Company Code -> Maintain Additional Parameters

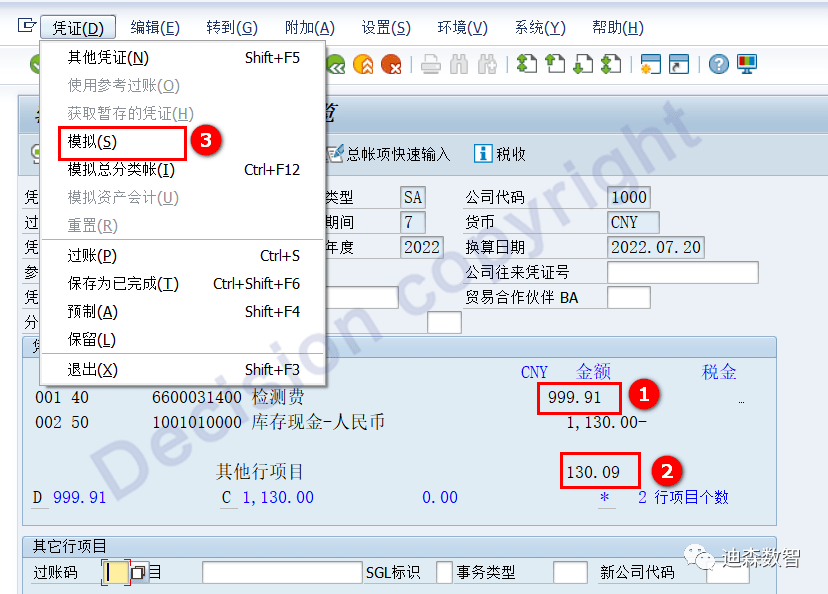

When entering the voucher, we test a 10-cent tail difference (13% tax amount is 999.91*13%= 129.99, an error of 10 cents = 130.09).

You can see that the simulated credentials are successful.

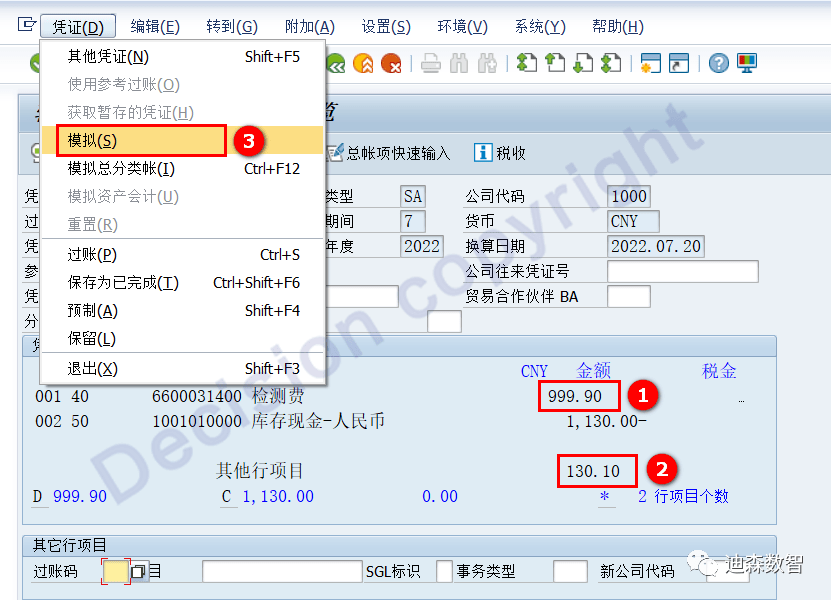

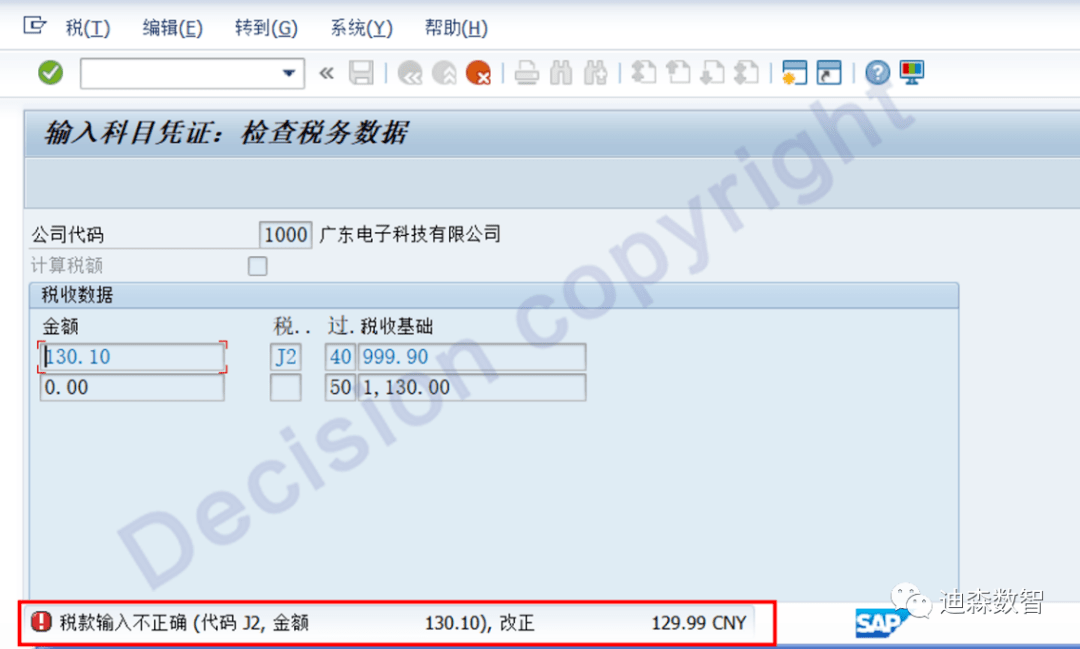

We then test the 11-cent tail difference (the 13% tax amount is 999.90*13%= 129.99, and the error is 11 cents = 130.10).

You can see that during the simulation display, the system prompts that the tax amount and tax rate do not match!

Summary 3: In this scenario, the system strictly requires that the tax amount matches the tax code! At this time, the tolerance is 0.01*10 = 0.10 yuan

Reference NOTES:

956637 - Tolerance check of tax for each company code can be defined

943614 - Too high tolerance in tax amount check

【Service Guide】

For more information on SAP courses, project consultation and operation and maintenance, please call Decision's official consultation hotline: 400-600-8756

【About Decision】

Global professional consulting, technology and training service provider, SAP gold partner, SAP software partner, SAP implementation partner, SAP official authorized training center. Seventeen years of quality, trustworthy!